[OLD] 🇪🇺 How does VAT number verification works?

Before automation, the verification process involved a 3-step manual procedure:

- Obtain the VAT number from the receipt.

- Verify the VAT number manually online.

- Assess the results and potentially record them in a database.

Now, with Taggun's receipt OCR AI, this cumbersome process is streamlined:

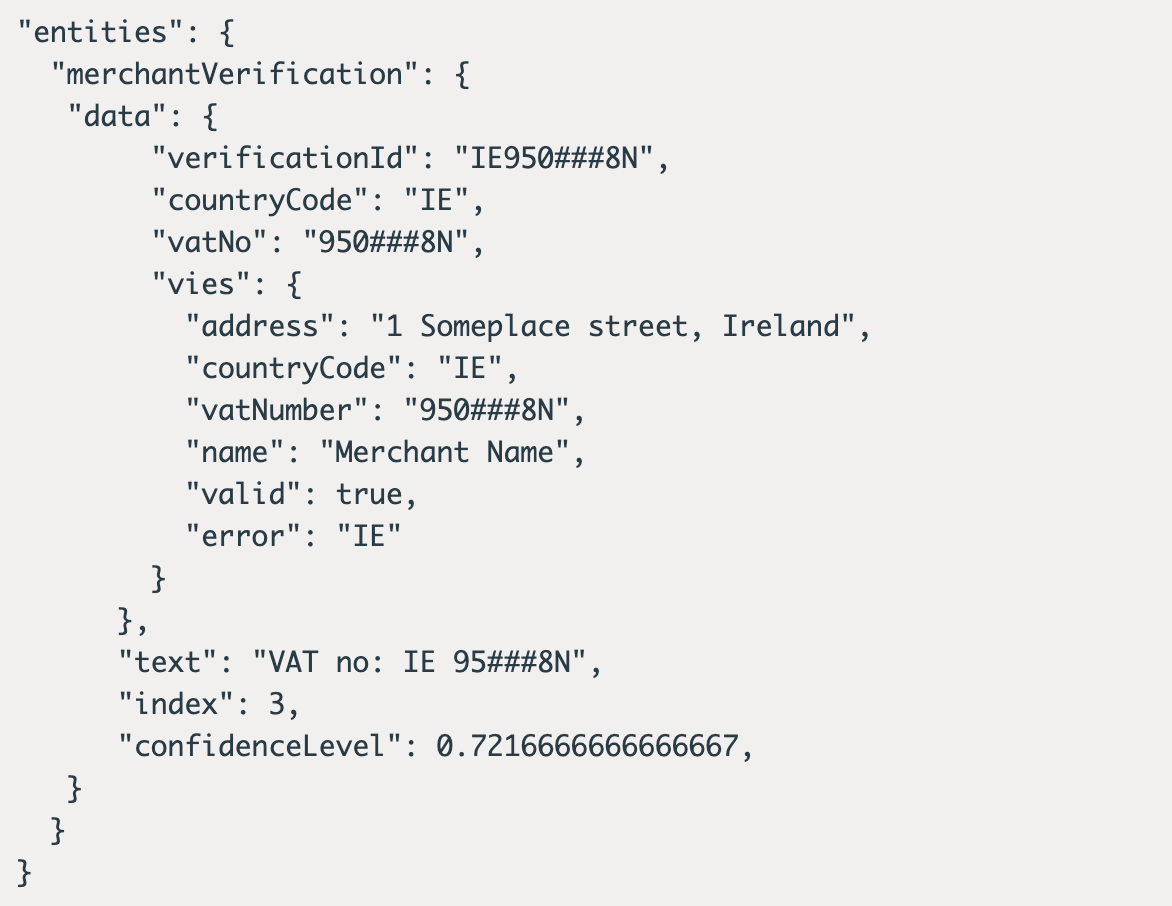

Taggun verifies the authenticity of the VAT number by using VIES to check its existence in the country's companies register.

Results are promptly returned with valid VAT numbers or an error message that offers insights into potential reasons for invalid numbers.

Example of Taggun's System in Action:

Let's say we have a VAT number from a receipt: GB 660 4548 36. Taggun sends this number to the VIES platform, which checks its existence in the UK's companies register. If it's valid, detailed information about the company is retrieved.

Technical Details:

- Taggun's system is trained to identify and extract VAT numbers from most EU countries.

- Pre-processing ensures accuracy before submitting VAT numbers to VIES for validation.

- The country code is inferred from IP/NEAR parameter information if not specified in the VAT number.

- Unique feature: Norwegian VAT numbers are also supported and can be validated using Taggun's system, something not currently possible with VIES.

Taggun's Future Plans:

- Expanding the list of countries for VAT verification, including other tax systems like GST for New Zealand.

- Optimizing the IP/NEAR parameter by using street address information for better country code inference.

Current Supported Countries:

EU Moss, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Great Britain, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden.

Updated 7 months ago